PSBs can’t be run like driverless cars: RBI

Flagging severe talent crunch at the top in public sector banks (PSBs), Reserve Bank of India Deputy Governor S S Mundra on Wednesday pressed for the need to focus on human resource management. He said there cannot be a “leaderless bank†even if autonomous vehicles edge closer to reality.

This assumes significance in the light of an ailing Chennai-based Indian Overseas Bank functioning without a managing director (MD) and chief executive officer (CEO) for the past two months.

“We are able to talk about a driverless cars but, I think, we are far from having a leaderless bank,†said Mundra, addressing the State Bank of India’s (SBI) banking and economic conclave.

His comments come to the fore as SBI chairperson Arundhati Bhattacharya’s three-year term ends on Saturday, but the government has not yet given her an extension or spoken about a successor so far.

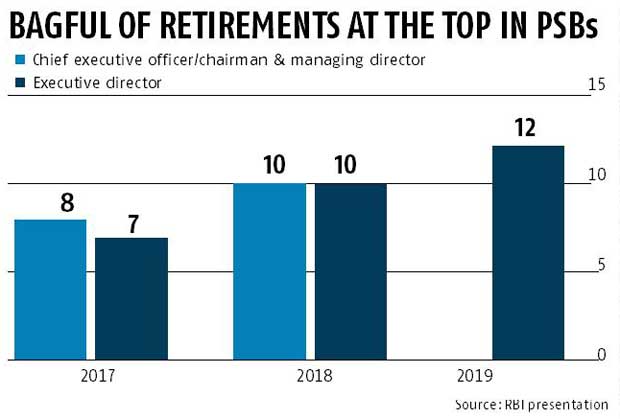

He pointed out that many MDs, CEOs and even chairman-managing directors of PSBs are retiring over the next few years.

“Of the 20 CEOs or CMDs at state-run banks, there is one vacant position at each one of them. Eight of them are retiring in 2017, 10 in 2018 and there would be only one who would be retiring beyond the next two years,†Mundra said.

On the second layer of leadership at banks, i.e., executive directors (EDs), Mundra said a stock of EDs is either already retired or retiring through the rest of this year.

“Five are retiring in 2016, seven in 2017, 10 in 2018, 12 in 2019 and the rest three will be retiring in 2020,†the deputy governor said.

Nearly 73 per cent of the deputy general managers and general managers put together at PSBs are above the age of 55. And, another 23 per cent are in the age group of 50-55, he added.

“So, this is the whole profile of leadership. The succession line is missing and, as I said earlier, it cannot be a driverless car. This is an area that needs serious attention,†Mundra added.

Weak link between credit and economic growth

Referring to the conventional link between economic growth and banks’ credit expansion, Mundra said the correlation is weakening due to proliferation of other institutions, and lenders will have to make a slew of changes to regain their share.

The link has weakened over the years, as banks have started accommodating companies through other sources like commercial paper (CP) and bonds, he said.

The share of non-bank sources like finance companies, housing finance companies (HFCs) and CPs has increased to 38.6 per cent in March, from 35.2 per cent in March 2014. The total credit dispensed by non-bank entities has increased to 37.40 per cent in these two years, which is twice the pace of the 19.22 per cent growth reported by banks, he added.

He advised banks to have a close look at their rising exposure to non-banking financial companies and HFCs. If this was outsourcing of their core function (of lending), he asked, referring to inter-connectedness. Mundra also said there is a move to have some risk weights on exposures to sovereigns. The RBI is opposing it at international fora, but if a five per cent risk weight for state bond holdings and two per cent for central government ones comes in, banks’ provisions will go up by up to Rs 7,000 crore.